ST 558 Project 3: World Analysis Report

Suyog Dharmadhikari; Bennett McAuley 2022-11-02

Introduction

The goal of this report is to create and compare predictive models using Online News Popularity data from the UCI Machine Learning Repository.

This data contains information about articles published by Mashable over a period of two years–specifically the statistics associated with them.

The purpose of this analysis is to use linear regression and ensemble

tree-based methods to predict the number of shares–our target

variable–subset by data channel. For more details about these methods,

see the Modeling section.

According to the data description, there are 39,797 observations and 61 variables present. 58 of them are predictors, but using all of them would be inefficient and show glaring redundancies. Instead, the ones that will be used were chosen intuitively–what might encourage a user to share an article, what underlying forces may influence them, and what would make for good exploratory analysis:

average_token_length- Average length of the words in the contentavg_negative_polarity- Avg. polarity of negative wordsglobal_rate_positive_words- Rate of positive words in the contentglobal_sentiment_polarity- Text sentiment polarityglobal_subjectivity- Text subjectivityis_weekend- Was the article published on the weekend?kw_avg_max- Best keyword (avg. shares)kw_avg_min- Worst Keyword (avg. shares)kw_max_max- Best keyword (max shares)kw_min_min- Worst keyword (min shares)n_non_stop_words- Rate of non-stop words in the contentn_tokens_content- Number of words in the contentn_tokens_title- Number of words in the titlen_unique_tokens- Rate of unique words in the contentnum_hrefs- Number of linksnum_imgs- Number of imagesnum_self_hrefs- Number of links to other articles published by Mashablenum_videos- Number of videosself_reference_avg_shares- Avg. shares of referenced articles in Mashabletitle_sentiment_polarity- Title polarityweekday_is_monday- Was the article published on a Monday?weekday_is_tuesday- Was the article published on a Tuesday?weekday_is_wednesday- Was the article published on a Wednesday?weekday_is_thursday- Was the article published on a Thursday?weekday_is_friday- Was the article published on a Friday?weekday_is_saturday- Was the article published on a Saturday?weekday_is_sunday- Was the article published on a Sunday?

Which we store in a vector for fast retrieval:

news.vars <- c('n_tokens_title', 'n_tokens_content', 'n_non_stop_words', 'num_hrefs',

'num_self_hrefs', 'num_imgs', 'num_videos', 'average_token_length',

'kw_max_max', 'kw_min_min', 'kw_avg_max', 'kw_avg_min',

'self_reference_avg_sharess','is_weekend', 'global_subjectivity', 'global_sentiment_polarity',

'global_rate_positive_words', 'avg_negative_polarity', 'n_unique_tokens', 'title_sentiment_polarity',

'weekday_is_sunday', 'weekday_is_monday', 'weekday_is_tuesday', 'weekday_is_wednesday',

'weekday_is_thursday', 'weekday_is_friday', 'weekday_is_saturday'

)

The Data

For this analysis, we will consider a single source for the data channel. In other words, we subset the data to the World channel.

So, we read in the data, perform the filter, and convert is_weekend

into a binary factor:

news <- read_csv("OnlineNewsPopularity.csv")

## Rows: 39644 Columns: 61

## ── Column specification ───────────────────────────────────────────────────────────────────────────

## Delimiter: ","

## chr (1): url

## dbl (60): timedelta, n_tokens_title, n_tokens_content, n_unique_tokens, n_non_stop_words, n_non...

##

## ℹ Use `spec()` to retrieve the full column specification for this data.

## ℹ Specify the column types or set `show_col_types = FALSE` to quiet this message.

fltr <- paste0("data_channel_is_", params$channel)

news.tbl <- news %>% filter(get(fltr) == 1) %>%

select(all_of(news.vars), shares) %>%

mutate(is_weekend = as.factor(is_weekend))

head(news.tbl)

## # A tibble: 6 × 28

## n_token…¹ n_tok…² n_non…³ num_h…⁴ num_s…⁵ num_i…⁶ num_v…⁷ avera…⁸ kw_ma…⁹ kw_mi…˟ kw_av…˟ kw_av…˟

## <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl> <dbl>

## 1 10 231 1.00 4 1 1 1 5.09 0 0 0 0

## 2 9 1248 1.00 11 0 1 0 4.62 0 0 0 0

## 3 12 682 1.00 10 0 1 0 4.62 0 0 0 0

## 4 9 391 1.00 9 2 1 1 5.30 0 0 0 0

## 5 11 125 1.00 1 1 1 0 4.82 0 0 0 0

## 6 11 799 1.00 8 6 1 0 4.70 0 0 0 0

## # … with 16 more variables: self_reference_avg_sharess <dbl>, is_weekend <fct>,

## # global_subjectivity <dbl>, global_sentiment_polarity <dbl>, global_rate_positive_words <dbl>,

## # avg_negative_polarity <dbl>, n_unique_tokens <dbl>, title_sentiment_polarity <dbl>,

## # weekday_is_sunday <dbl>, weekday_is_monday <dbl>, weekday_is_tuesday <dbl>,

## # weekday_is_wednesday <dbl>, weekday_is_thursday <dbl>, weekday_is_friday <dbl>,

## # weekday_is_saturday <dbl>, shares <dbl>, and abbreviated variable names ¹n_tokens_title,

## # ²n_tokens_content, ³n_non_stop_words, ⁴num_hrefs, ⁵num_self_hrefs, ⁶num_imgs, ⁷num_videos, …

Summarizations

Now that our data has been manipulated and filtered, we can perform a simple EDA.

Summary Statistics

First and foremost, we want to know what range of values we might expect

when predicting for shares. The following table shows basic summary

statistics about the variable:

s <- summary(news.tbl$shares)

tibble(var = 'shares', min = s[1], max = s[6], mean = s[3], stddev = sd(news.tbl$shares))

## # A tibble: 1 × 5

## var min max mean stddev

## <chr> <table> <table> <table> <dbl>

## 1 shares 35 284700 1100 6090.

If the maximum is tremendously larger in scale than the mean, then it is very likely an outlier. If the standard deviation is larger than the mean, then the number of shares varies greatly. Furthermore, the higher it is, the more disperse they are from the mean. The inverse also applies for a smaller standard deviation (i.e. the smaller, the less disperse).

It would also be good to know relationships between some of the

variables present–and not just to shares. Observe the following

correlation matrix of variables related to content sentiment. A value of

0 indicates no correlation and 1 indicates perfect correlation. The

closer a value is to 1(+/-), the stronger the relationship is. The

closer to 0, the weaker.

c <- news.tbl %>%

select(avg_negative_polarity,

global_rate_positive_words,

global_sentiment_polarity,

global_subjectivity,

shares)

round(cor(c),2)

## avg_negative_polarity global_rate_positive_words

## avg_negative_polarity 1.00 -0.10

## global_rate_positive_words -0.10 1.00

## global_sentiment_polarity 0.23 0.63

## global_subjectivity -0.45 0.53

## shares -0.01 0.02

## global_sentiment_polarity global_subjectivity shares

## avg_negative_polarity 0.23 -0.45 -0.01

## global_rate_positive_words 0.63 0.53 0.02

## global_sentiment_polarity 1.00 0.33 0.03

## global_subjectivity 0.33 1.00 0.02

## shares 0.03 0.02 1.00

The new variable popularity is set up so that news is considered

popular if it receives more shares than the median shares. Otherwise,

it is considered unpopular.table() gives details about count of

popular and unpopular news.

news.tbl$popularity <- ifelse(news.tbl$shares < mean(news.tbl$shares),

"Unpopular", "Popular")

table(news.tbl$popularity)

##

## Popular Unpopular

## 1646 6781

The contingency table below depicts the relationship between the popularity of a news channel and whether or not it was published on the weekend. It informs us whether or not popular news was published over the weekend. Whether or not unpopular news was published over the weekend.

table(news.tbl$popularity,news.tbl$is_weekend)

##

## 0 1

## Popular 1345 301

## Unpopular 5996 785

Plots

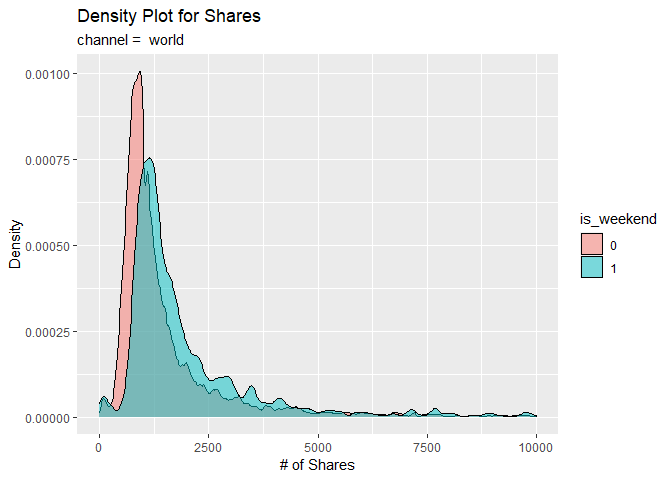

For visual analysis, we first construct a density plot to compare the

densities of shares between the weekend (is_weekend = 1) and

weekdays (is_weekend = 0). Observe the patterns generated for

similarities and/or differences.

g <- ggplot(data = news.tbl, aes(x = shares))

g + geom_density(adjust = 0.5, alpha = 0.5, aes(fill = is_weekend)) +

xlim(0, 10000) +

scale_y_continuous(labels = scales::comma) +

labs(title = "Density Plot for Shares",

subtitle = paste("channel = ", params$channel),

x = "# of Shares",

y = "Density")

## Warning: Removed 254 rows containing non-finite values (stat_density).

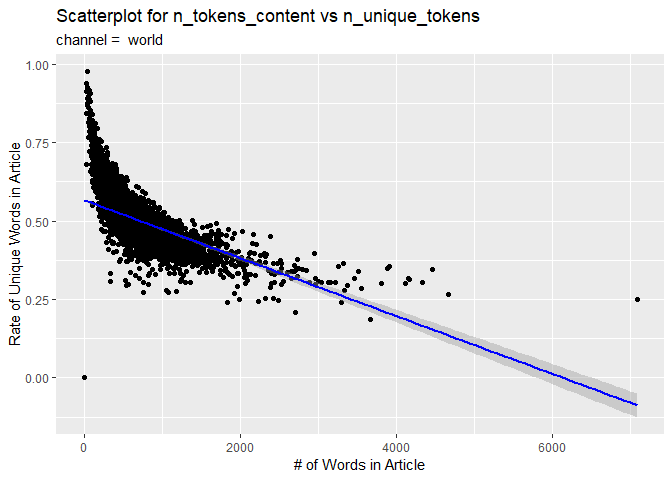

The second visual is a scatterplot with a trend line. The number of words in the content is on the x-axis and the rate of unique words on the y-axis. If the data points and trend line show an upward trend, then articles with more words tend to have a larger rate of unique ones. If there is a downward trend, then articles with more words tend to have a smaller rate of unique ones.

p <- ggplot(news.tbl, aes(x = n_tokens_content, y = n_unique_tokens))

p + geom_point() +

geom_smooth(method = glm, col = "Blue") +

labs(title = "Scatterplot for n_tokens_content vs n_unique_tokens",

subtitle = paste("channel = ", params$channel),

x = "# of Words in Article",

y = "Rate of Unique Words in Article")

## `geom_smooth()` using formula 'y ~ x'

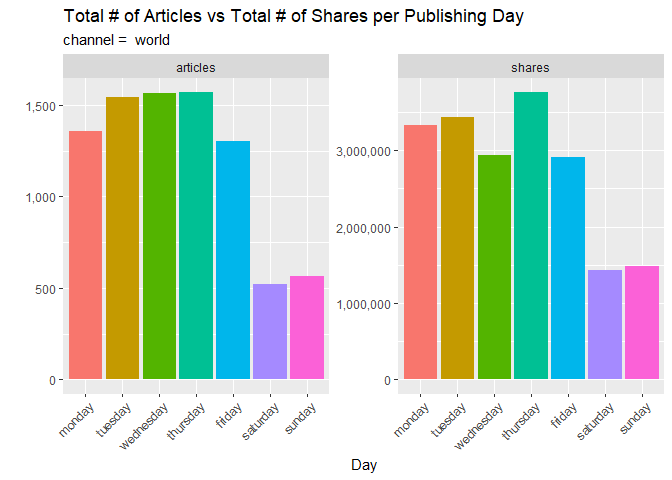

This subsequent bar plot shows a comparison between the total number of articles published on each day of the week and the total shares of those articles. Observe any interestingly sized columns that one might think would be higher or lower than others. Articles published on which day tend to get shared the most? Which one gets the least?

plt <- news.tbl %>% pivot_longer(cols = starts_with("weekday_is_"),

names_to = "day",

names_prefix = "weekday_is_",

names_transform = as.factor,

values_to = "count") %>%

filter(count == 1) %>%

select(-count, -starts_with("weekday_is_"))

#Reordering days

plt$day <- factor(plt$day,

levels = c("monday", "tuesday", "wednesday", "thursday",

"friday", "saturday", "sunday"))

plt <- plt %>%

select(day, shares) %>%

group_by(day) %>%

summarise(articles = n(), shares = sum(shares))

plt <- reshape2::melt(plt, id.vars = c("day"))

p <- ggplot(plt, aes(x = day, y = value, fill = day))

p + geom_col() +

facet_wrap(vars(variable), scales = "free") +

scale_y_continuous(labels = scales::comma) +

guides(x = guide_axis(angle = 45), fill = "none") +

labs(title = "Total # of Articles vs Total # of Shares per Publishing Day",

subtitle = paste("channel = ", params$channel),

x = "Day",

y = '')

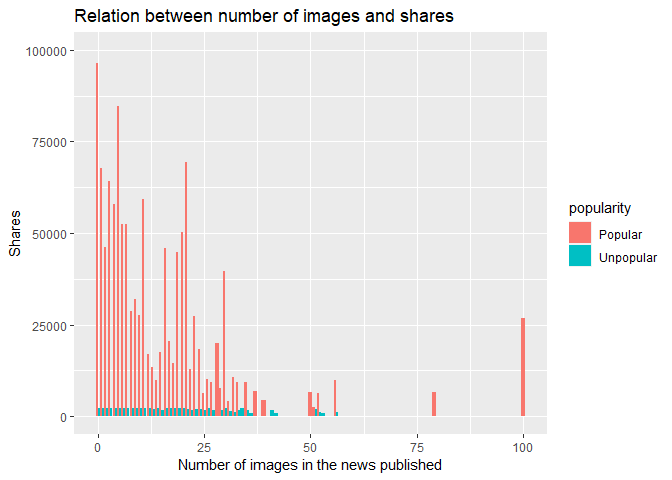

The code chunk below, tells us about the number of shares of a particular published news with number of images in the published news. It also tells us about the popularity of the news published with images.

ggplot(news.tbl, aes(fill= popularity, y=shares, x=num_imgs)) +

geom_bar(position='dodge', stat='identity', width = 0.98) +

ggtitle('Relation between number of images and shares') +

xlab('Number of images in the news published') +

ylab('Shares') +

ylim(0, 100000)

## Warning: Removed 6 rows containing missing values (geom_bar).

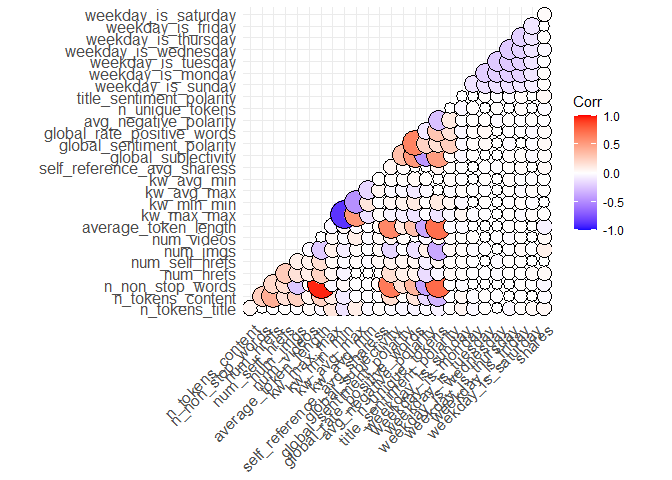

Correlation plots are used to find out the correlation between two

variables in the given data set. In the code chunk below, we have used

ggcorrplt() to plot the correlation between all the variables in the

data set and identify the most correlated variables. A violet

color circle shows there is negative correlation between the two

respective variables and a dark orange color is positive

correlation between two variables.

corr <- cor(select_if(news.tbl, is.numeric))

ggcorrplot(corr,

method = "circle",

type = "lower",

outline.color = "black",

lab_size = 6)

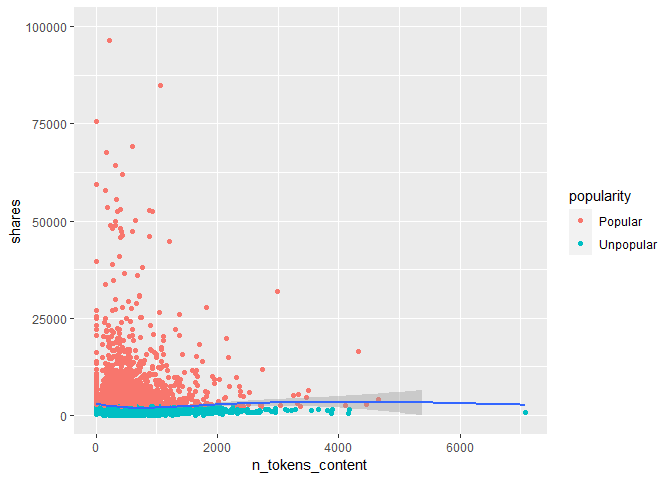

In the code chunk a scatter plot with a trend line. The number of words in the content is on the x-axis and the number of shares on the y-axis. If the data points and trend line show an upward trend, then articles with more words tend to have more number of shares. If there is a downward trend, then articles with more words tend to have a smaller number of shares.

ggplot(news.tbl, aes(y=shares, x=n_tokens_content)) +

geom_point(aes(color=popularity)) +

geom_smooth() +

ylim(0, 100000)

## `geom_smooth()` using method = 'gam' and formula 'y ~ s(x, bs = "cs")'

## Warning: Removed 6 rows containing non-finite values (stat_smooth).

## Warning: Removed 6 rows containing missing values (geom_point).

Modeling

The goal now is to create models for predicting the number of shares

using linear regression and ensemble trees. Before that, the data is

split into a training (70%) and test (30%) set.

i <- createDataPartition(news.tbl[[1]], p = 0.7, list = FALSE)

train <- news.tbl[i,]

test <- news.tbl[-i,]

Linear Regression

Linear regression is a statistical technique that aims to demonstrate a relationship between variables. A dependent variable’s nature and degree of connection with a group of independent variables are assessed using linear regression. Symbolically: \(Y_i = \beta_0 + \beta_1 x_i + \epsilon_i\) where $Y_i$ is the dependent variable/response value, $\beta_0$ is the intercept, and $\beta_1$ is the slope coefficient for observation value $x_i$

We can make predictions of shares using linear regression models.

Model 1

The linear regression model is fit using variables chosen from forward

stepwise selection. The leaps library’s regsubsets() function performs

best subset selection by identifying the best model with a given number

of predictors, where best is quantified using $RSS$. The syntax is

identical to that of lm(). The summary() command returns the best set

of variables for each model size. In the code chunk below, we find the

best predictors subset, then $R^2$ value is used to determine the number

of predictors that can give best model results. Then we create a formula

that can be used to train the model by using as.formula() and

paste0().

fwdVars <- regsubsets(shares ~ ., train, method = "forward")

## Warning in leaps.setup(x, y, wt = wt, nbest = nbest, nvmax = nvmax, force.in = force.in, : 2 linear

## dependencies found

## Reordering variables and trying again:

fwdSumm <- summary(fwdVars)

adjRNum <- which.max(fwdSumm$adjr2)

bestModels <- fwdSumm$which[adjRNum,-1]

varNames <- names(which(bestModels == TRUE))

predictorFormulaPt2 <- paste(varNames, collapse = "+")

modelFormula <- as.formula(paste0("shares", "~", predictorFormulaPt2))

modelFormula

## shares ~ n_tokens_title + n_tokens_content + num_hrefs + num_imgs +

## average_token_length + global_subjectivity + global_sentiment_polarity +

## weekday_is_wednesday + popularityUnpopular

## <environment: 0x000002049755d2f8>

In the code chunk below, firstly we have converted categorical variables

into numerical variables using dummyVars(). gsub() is used to rename

the column names in order to match with the column names generated by

regsubsets() in the function above. The caret package was used to

train a linear regression model by using the best predictors obtained

from regsubsets(). We have standardized the model using

center and scale. Cross validation is used to avoid over fitting and

add generalization in our model.

# convert categorical variables into numeric variables i.e one hot encoding

dummies <- dummyVars(shares ~ is_weekend+popularity, data = train)

trainDF <- as_tibble(predict(dummies, newdata = train)) %>%

bind_cols(select(train,-is_weekend,-popularity))

# Replace . with spaces in column names to match the output names from regsubsets

names(trainDF) <- gsub(x = names(trainDF), pattern = "\\.", replacement = "")

forwardFit <- train(modelFormula,

data = trainDF,

method = "lm",

metric = "Rsquared",

preProcess = c("center","scale"),

trControl = trainControl(method = "cv", number = 10))

summary(forwardFit)

##

## Call:

## lm(formula = .outcome ~ ., data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -6180 -589 -102 354 120008

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2219.99 56.90 39.018 < 2e-16 ***

## n_tokens_title 165.14 57.13 2.891 0.003858 **

## n_tokens_content -238.09 66.28 -3.592 0.000331 ***

## num_hrefs 237.34 63.96 3.711 0.000208 ***

## num_imgs 260.11 62.45 4.165 3.16e-05 ***

## average_token_length -214.76 75.81 -2.833 0.004631 **

## global_subjectivity 287.80 77.05 3.735 0.000189 ***

## global_sentiment_polarity -135.63 60.95 -2.225 0.026116 *

## weekday_is_wednesday -120.30 56.96 -2.112 0.034721 *

## popularityUnpopular -2284.30 57.94 -39.427 < 2e-16 ***

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4371 on 5891 degrees of freedom

## Multiple R-squared: 0.2313, Adjusted R-squared: 0.2301

## F-statistic: 196.9 on 9 and 5891 DF, p-value: < 2.2e-16

Now we use the model to make predictions:

# convert categorical variables into numeric variables i.e one hot encoding

dummies <- dummyVars(shares ~ is_weekend+popularity, data = test)

testDF <- as_tibble(predict(dummies, newdata = test)) %>%

bind_cols(select(test,-is_weekend,-popularity))

predLR <- predict(forwardFit,newdata = testDF)

predResultsFwd <- postResample(predLR,obs = testDF$shares)

predResultsFwd

## RMSE Rsquared MAE

## 7630.443458 0.116278 1521.932315

Model 2

This second linear regression model is fit using variables chosen from backwards stepwise selection.

The regsubsets function is called, and the summary is returned to grab

the models of $n$ terms that have the optimal values for $R^2$, Mallows’

Cp, and BIC. As performance will vary, the mode value between the three

is chosen as the ‘best’.

backVars <- regsubsets(shares ~ ., train, method = "backward")

## Warning in leaps.setup(x, y, wt = wt, nbest = nbest, nvmax = nvmax, force.in = force.in, : 2 linear

## dependencies found

## Reordering variables and trying again:

backSumm <- summary(backVars, all.best = FALSE)

met <- c(R2 = which.max(backSumm$rsq),

Cp = which.min(backSumm$cp),

BIC = which.min(backSumm$bic)

)

M <- which.max(tabulate(met))

The most frequent number is 9. The variables present in this size model are:

terms <- coef(backVars, M)

terms

## (Intercept) n_tokens_title num_hrefs

## 1.567613e+03 1.003889e+02 4.420527e+01

## num_imgs average_token_length kw_max_max

## 1.056280e+02 -1.182415e+03 -6.236860e-05

## global_subjectivity global_sentiment_polarity n_unique_tokens

## 4.584708e+03 -1.183615e+03 5.153387e+03

## weekday_is_saturday

## 5.244028e+02

Now, the model can be trained. The coefficient names are grabbed from the backwards selection, and input as a subset of the training data. The variables are standardized to account for the vastly different magnitudes between them, and to prevent any extreme coefficient values because of this.

prd <- names(terms)

#Assuming these terms appear in the model, but just a warning otherwise

prd <- replace(prd, prd %in% c('(Intercept)', 'is_weekend1'), c('shares', 'is_weekend'))

## Warning in x[list] <- values: number of items to replace is not a multiple of replacement length

BackwardFit <- train(shares ~ .,

data = train[,prd],

method = "lm",

metric = "Rsquared",

preProcess = c("scale", "center"),

trControl = trainControl(method = "cv", number = 10))

summary(BackwardFit)

##

## Call:

## lm(formula = .outcome ~ ., data = dat)

##

## Residuals:

## Min 1Q Median 3Q Max

## -8133 -1423 -786 -55 123109

##

## Coefficients:

## Estimate Std. Error t value Pr(>|t|)

## (Intercept) 2219.99 63.88 34.752 < 2e-16 ***

## n_tokens_title 208.99 64.66 3.232 0.00123 **

## num_hrefs 417.82 70.20 5.951 2.81e-09 ***

## num_imgs 543.35 69.65 7.801 7.20e-15 ***

## average_token_length -1036.14 109.66 -9.449 < 2e-16 ***

## kw_max_max -11.11 65.27 -0.170 0.86486

## global_subjectivity 495.93 86.35 5.743 9.75e-09 ***

## global_sentiment_polarity -96.09 68.64 -1.400 0.16157

## n_unique_tokens 636.14 104.67 6.077 1.30e-09 ***

## weekday_is_saturday 128.89 64.01 2.014 0.04410 *

## ---

## Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

##

## Residual standard error: 4907 on 5891 degrees of freedom

## Multiple R-squared: 0.03095, Adjusted R-squared: 0.02947

## F-statistic: 20.91 on 9 and 5891 DF, p-value: < 2.2e-16

The model is then tested against the testing data:

predLRBck <- predict(BackwardFit, newdata = test)

predResultsBck <- postResample(predLRBck, obs = test$shares)

predResultsBck

## RMSE Rsquared MAE

## 8.059496e+03 1.220383e-02 2.030549e+03

Random Forest

Random forest uses the same idea as bagging tree models. It is a bootstrap aggregation method, but the difference is that random forests randomly select a subset of predictors instead of using all the predictors. This is because if a really strong predictor exists, every bootstrap tree will probably use it for the first split. This will result in making bagged trees predictions more correlated, and variance will be large in aggregation. Hence, in random forest we avoid this limitation by using a random subset of predictors for each bootstrap sample/tree fit.

In the code chunk below, caret package was used to train the rf forest

model and the evaluation metric used for the fit is Rsquared. We have

tuned the model by using tuning parameter mtry ad used 5 folds cross

validation for finding best fit.

#5 folds cross validation

control <- trainControl(method='cv',

number=5)

tunegrid <- data.frame(mtry = 1:9)

rfFit <- train(modelFormula,

data=trainDF,

method='rf',

metric='Rsquared',

tuneGrid=tunegrid,

trControl=control)

rfFit$bestTune

## mtry

## 1 1

varImp(rfFit$finalModel) %>% arrange(desc(Overall))

## Overall

## popularityUnpopular 21203754843

## global_sentiment_polarity 8104988144

## n_tokens_content 7678074397

## average_token_length 7607489489

## num_hrefs 7391079175

## global_subjectivity 7384481872

## num_imgs 6667080752

## n_tokens_title 6580559526

## weekday_is_wednesday 580957049

# convert categorical variables into numeric variables i.e one hot encoding

dummies <- dummyVars(shares ~ is_weekend+popularity, data = test)

testDF <- as_tibble(predict(dummies, newdata = test)) %>%

bind_cols(select(test,-is_weekend,-popularity))

predRF <- predict(rfFit,newdata = testDF)

predResultsRF <- postResample(predRF,obs = testDF$shares)

predResultsRF

## RMSE Rsquared MAE

## 7690.182248 0.118991 1454.685575

Boosted Tree Model

Boosting centers around the idea of sequential learning–taking information from preceding iterations as a basis for calculating the current iteration. Boosted trees are ensemble tree models consisting of a group of trees that are built in sequence, including errors from previous trees for predictions.

Boosted trees also have a unique characteristic of slow training. This

is controlled by $\lambda$, a shrinkage parameter. The two other notable

parameters for training a boosted tree are $B$ (the number of times the

algorithm performs its procedure; n.trees in R) and $d$ (the number of

splits; interaction.depth in R), both of which can be selected with

cross-validation.

For regression, the boosting algorithm proceeds as follows:

- The predictions are initialized to 0–$\hat{y}(x)=0$

- The residuals between observed and predicted values are calculated

- A tree with $d$ splits and $d+1$ terminal nodes is fit using the residuals as the response–denoted by $\hat{y}^b(x)$

- The overall prediction is updated by recursively adding these pseudo-responses–$\hat{y}(x) +=\lambda\hat{y}^b(x)$

- Residuals for new predictions are updated

- Repeat $B$ times

This model is fit using cv = 10, and the train function will

determine the optimal values of the parameters for us.

#Output for this chunk is hidden as it is rather long and does not provide information needed for reporting

boostFit <- train(shares ~ .,

method = "gbm",

data = train,

trControl = trainControl(method = "cv", number = 10))

During training, the optimal values for the tuning parameters were found to be:

boostFit$bestTune

## n.trees interaction.depth shrinkage n.minobsinnode

## 1 50 1 0.1 10

Since coefficients aren’t interpretable for boosted trees, the calculation of variable importance for the final model is shown instead, in descending order:

varImp(boostFit$finalModel) %>% arrange(desc(Overall))

## Overall

## popularityUnpopular 83760208728

## num_hrefs 5609929032

## n_tokens_title 5026157752

## num_imgs 4748795375

## self_reference_avg_sharess 1221365040

## kw_avg_min 691504040

## average_token_length 617837128

## global_sentiment_polarity 525061001

## avg_negative_polarity 478081500

## n_tokens_content 0

## n_non_stop_words 0

## num_self_hrefs 0

## num_videos 0

## kw_max_max 0

## kw_min_min 0

## kw_avg_max 0

## is_weekend1 0

## global_subjectivity 0

## global_rate_positive_words 0

## n_unique_tokens 0

## title_sentiment_polarity 0

## weekday_is_sunday 0

## weekday_is_monday 0

## weekday_is_tuesday 0

## weekday_is_wednesday 0

## weekday_is_thursday 0

## weekday_is_friday 0

## weekday_is_saturday 0

Now, the results of applying the boosted tree to the test data:

predBoost <- predict(boostFit,newdata = test)

predResultsBoost <- postResample(predBoost,obs = test$shares)

predResultsBoost

## RMSE Rsquared MAE

## 7671.6774624 0.1066828 1493.2944002

Model Comparison

The metric results of each model are returned in the table below. The metric that they are “judged” against is RMSE, and the model with the minimum value is the “winner”.

rmseModels <- c(predResultsFwd[[1]],predResultsBck[[1]],

predResultsRF[[1]],predResultsBoost[[1]])

modelName <- c("Linear Regression (Forward Var. Selection)", "Linear Regression (Backward Var. Selection)",

"Random foresF", "Boosted Tree")

resultsDF <- tibble(modelName, rmseModels)

resultsDF

## # A tibble: 4 × 2

## modelName rmseModels

## <chr> <dbl>

## 1 Linear Regression (Forward Var. Selection) 7630.

## 2 Linear Regression (Backward Var. Selection) 8059.

## 3 Random foresF 7690.

## 4 Boosted Tree 7672.

bestModelName <- filter(resultsDF,rmseModels == min(rmseModels))[[1]]

paste0("The best model for the ", params$channel, " channel is: ", bestModelName)

## [1] "The best model for the world channel is: Linear Regression (Forward Var. Selection)"